MORE THAN JUST A THEATER COMPANY. IT’S A TRADITION. IT’S A PLACE. IT’S A FEELING.

Your support now with a year-end charitable contribution will help keep the power of performance accessible to everyone. Your support is absolutely essential to bring our celebratory 2025 season to life, as well as empowering our impactful Education and Engagement work in schools and communities across the Hudson Valley!

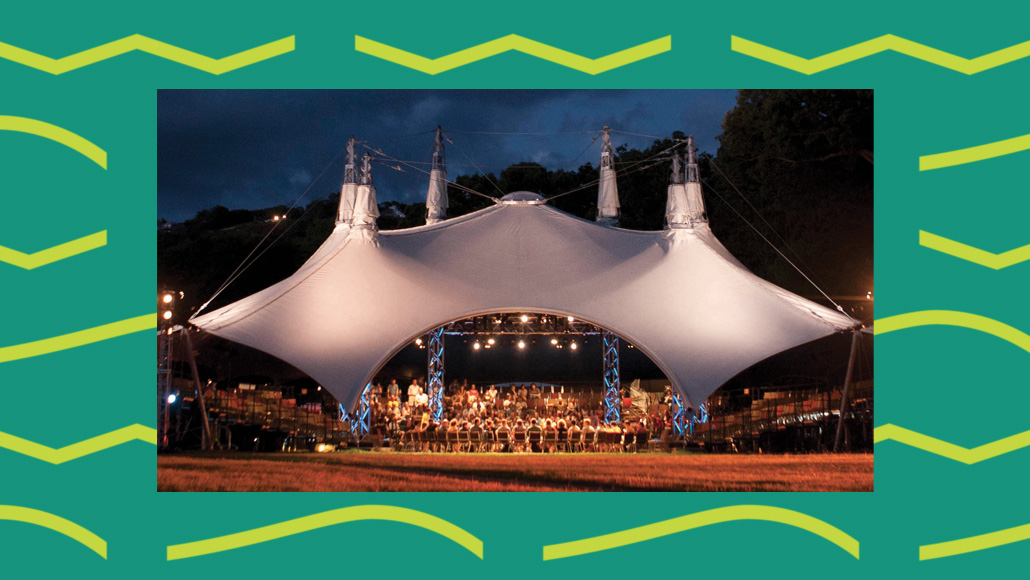

But before we cut the ribbon on our magnificent new open-air theater in the summer of 2026, we’ll gather next year for a final season in our beloved tent, to celebrate our artistic legacy, honor the magical summer evenings we’ve shared over the last three decades, and look forward to the exciting possibilities ahead.

The moment has finally arrived — the construction of our first-ever permanent home, the Samuel H. Scripps Theater Center, is now underway! It’s a dream come true, and a dream that belongs to all of us – to all the artists, audiences, patrons, donors, supporters who have nurtured and supported Hudson Valley Shakespeare over its 37 glorious years.

More Ways to Give

Make a One-Time Donation

We welcome gifts of any amount! Make a tax-deductible donation online, during your ticket purchase, or by mail to:

Hudson Valley Shakespeare

P.O. Box 125

Garrison, NY 10524

Join a Membership Program

Find greater connection within our vibrant theater community while making a generous investment in HVS’s future! By joining our Saints & Poets Society or Festival Circles Program, you’ll gain access to artistic insights and special events, and have the opportunity to purchase season tickets ahead of the crowd.

Employer Matching Gifts

Many employers sponsor matching gift programs and will match any charitable contributions made by their employees. If eligible, the impact of your gift to HVS could be doubled or even tripled, and you’ll be recognized at the donor level of the combined gift amount! Talk to your employer or human resources department to determine whether your gift to HVS is eligible for a match, then contact Interim Director of Development Stephanie Paul to learn more.

Stocks and Securities

Gifts of stock or other securities are a meaningful way to support HVS’s work all year-round, and the IRS provides some of its most significant tax breaks for donations of appreciated assets. Contact Interim Director of Development Stephanie Paul to learn more.

Donor Advised Fund (DAF)

Consider a gift through a DAF. This flexible charitable giving vehicle allows you to maximize your contributions while enjoying significant tax benefits. By giving through a DAF, you’re not just donating; you’re investing in a brighter future for our community.If you are 70½ years or older, you can give up to $100,000 from your IRA directly to a qualified charity such as HVS without having to pay income taxes on the donation. This charitable rollover can satisfy all or part of your required minimum distribution for the year, and it’s easy to do – simply ask your IRA administrator to make the transfer and contact Interim Director of Development Stephanie Paul to learn more.

IRA Rollovers

If you are 70½ years or older, you can give up to $100,000 from your IRA directly to a qualified charity such as HVS without having to pay income taxes on the donation. This charitable rollover can satisfy all or part of your required minimum distribution for the year, and it’s easy to do – simply ask your IRA administrator to make the transfer and contact Interim Director of Development Stephanie Paul to learn more.

Legacy Gifts: The Sheila Allen Colby Legacy Giving Program

If HVS has made a difference to you and your family, we hope you will consider remembering the Festival in your estate plan and/or as a beneficiary of a charitable trust, retirement plan, or life insurance policy. Your support will ensure the vitality of Shakespeare within the Hudson Valley for years to come! Contact Interim Director of Development Stephanie Paul to learn more.

With a legacy gift you can:

- Make a more significant charitable gift than you may have thought possible

- Reduce your income tax and avoid capital gains taxes

- Leave a legacy without giving up assets during your lifetime

Make us part of your estate plan by:

- Making a bequest to HVS in your will

- Designating HVS as a beneficiary of an IRA, annuity, or life insurance contract

- Naming HVS as a beneficiary or charitable trust

This program is named for the inimitable Sheila Allen Colby. To Sheila, HVS was where she could enjoy intimate, moving, and magical performances along with the world’s natural beauty in the most dramatic of settings. For this reason, and for all the joy it brought to her and her family, Sheila generously made a legacy gift to the Hudson Valley Shakespeare.